Improve Customer Experiences, Operational Efficiency,

Improve Customer Experiences, Operational Efficiency,

Regulatory Compliance, and Risk Management

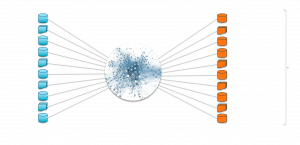

Anzo helps financial services organizations connect and model enterprise data in scalable knowledge graphs that deliver transformative efficiencies and insights to fuel improved customer experiences, operational efficiency, regulatory compliance, and risk management.